The City of Miami’s Opportunity Zones have a wide range of parcel types. Every parcel is unique due to the multitude of factors that affect how they can be used. In previous posts, I’ve identified value-add propositions for owners, developers and brokers by aggregating different parcel data sets [1] with Miami21 zoning regulations. This unlocks insight into the simple question of what can one build on a parcel.

Today, I will examine the parcel make up of Miami Opportunity Zones from a bird’s-eye view, and speculate on optimal zoning types for development. The main consideration for these will be the availability of parcels, based strictly on the percentage of zoning types in the tables below.

In total, there are approximately 19,000 parcels within Opportunity Zones. Of these, 84% or about 16,500 have existing buildings on them. Only 16% or about 3,100 parcels are vacant land. And, only 10% of the total are zoned T6-8 or higher.

This results in the following:

The majority of the parcels lend themselves to rehab projects, or, demolition is required of the existing building, raising upfront capital costs of construction.

Vacant land parcels in the zones are minimal, but available, as I've unpacked before.

Large scale development opportunities are scarce on single parcels, due to the low quantity that are zoned T6-12 or higher.

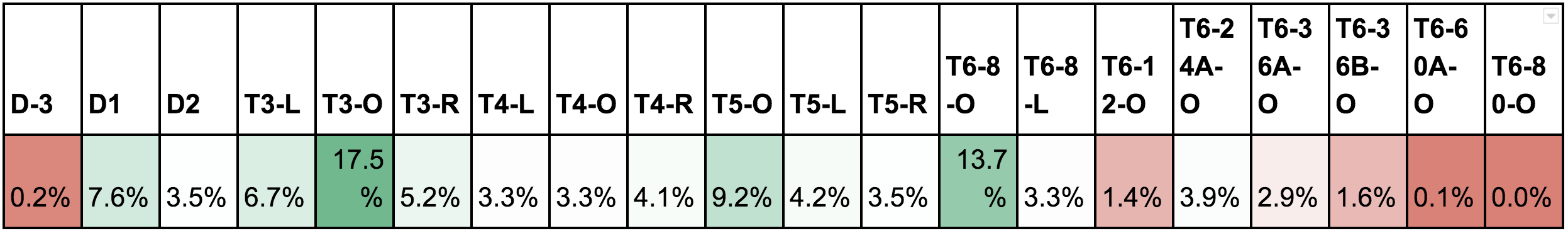

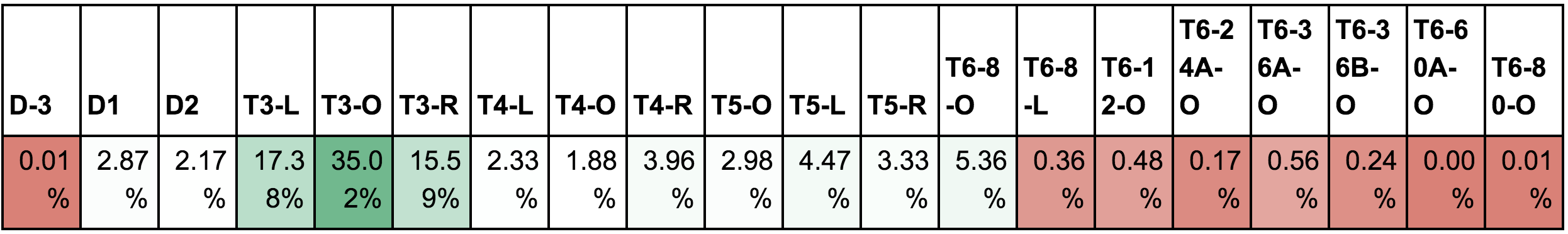

For a more in-depth breakdown, see the two tables [2]:

Zoning Code Breakout: Vacant Building Parcels

*percentage based on total vacant land parcels

Zoning Code Breakout: Existing Land Parcels

*percentage based on total existing land parcels

Clearly, the majority of the opportunity zones are comprised of T3-O, (single family) parcels. There is also a lack of zoning types for major development, T6-12 and above. But, we have uncovered two potentially impactful insights:

Approximately 8% of designated opportunity zones are T6-8-O, a potential sweet spot for owners, developers and brokers.

The D1 and D2 zoning types (workplace) comprise about 7% of designated opportunity zones. They allow for a maximum of eight stories, and a unit density of 36 units.

Conclusions

Overall, the City of Miami lends itself to rehab projects within Opportunity Zones due to the sheer volume of parcels that contain existing building [3]. This may limit Opportunity Zone Funds that could deploy capital here, as rehab projects can be a specialized endeavor. The scarcity of more urban zoned parcels may lead to overvaluation and limit development from large scale development companies.

Alternatively, there is ample opportunity for small to midsize development within Miami Opportunity Zones. Specifically, T6-8-O, D1, and D2 zoning types offer substantial opportunity for owners and developers. Depending on their specific location, these parcels could unlock extreme value plays if one were to maximize the Miami 21 code and the long term incentives offered by the zones.

Next week, I’ll be looking into specific opportunities for T6-8-O, D1 and D2 within Miami Opportunity Zones.

Notes:

Data aggregation offers unparalleled insight when applied to specific locations across the city. Opportunity Zones, Zoning Types, Land Types, RDIA, and TOD’s all offer different ways of uncovering unique property value-add scenario’s.

These tables are a simple aggregation of all the zoning types that comprise the Opportunity Zones. Please contact us directly for the hard number breakout.

This position is made strictly within the confines of the quantities of zoning types. It does not take into account location, a large factor in any development decision.